Guidance note for complex corporate structures

Since 6 April 2016, all UK companies1 (save for certain listed companies which are exempt2) have been required to register all those people who have significant control over them (their PSCs) on a PSC register which they must maintain. They also need to supply that information to Companies House. A brief overview of the key obligations under the PSC regime can be found here.

This note helps companies identify who are their PSCs, in particular it looks at indirect ownership structures, group company arrangements etc. Companies with more simple ownership structures should first of all take a look at the simplified note here.

The PSC regime also applies to UK LLPs but with modifications to reflect their different ownership structures. This note should be read as applying also to LLPs though further advice will need to be sought to identify any additional considerations.

This note is only abbreviated guidance to help companies identify their PSCs. Further helpful materials include the Government’s detailed non-statutory guidance (here) (“the Government Guidance”) and the draft statutory guidance explaining the meaning of “significant control or influence” for companies (here).

Identifying PSCs

A company must take “reasonable steps” to identify and notify registrable persons. The Government Guidance gives examples of what is meant by reasonable steps and further commentary on this is given at Appendix 1.

One important point to note is that even if a company has come to the conclusion that it does not have any PSCs or registrable RLEs (explained below) the PSC register must not be left blank. In those circumstances the PSC register must use a prescribed form of wording to confirm there are no registrable persons.

Who is a PSC?

Individuals

The regime provides that a PSC must be an individual who meets any one of the following five control conditions in relation to the company3:

(i) holds, directly or indirectly, more than 25% by nominal value of the company’s shares;

(ii) is entitled, directly or indirectly, to exercise more than 25% of the voting rights of the company;

(iii) may, directly or indirectly, appoint or remove a majority of the board of directors of the company;

(iv) has the right to exercise or actually exercises “significant influence or control” over the company; or

(v) has the right to exercise or actually exercises “significant influence or control” over a trust or firm which is not a legal entity but which itself satisfies one of the above conditions.

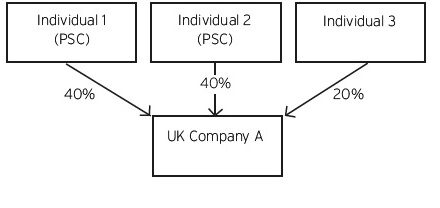

Example 1 – individuals with direct control

A simple example of control via shareholding rights is set out below:

In this diagram individual 1 and Individual 2 are PSCs are they both meet control condition (i), they each own more than 25% of the shares of company A. If all shares in the company hold one vote each then they also meet control condition (ii). Individual 3 does not hold sufficient shares to meet either condition (i) or (ii). The diagram assumes that none of the individuals have any special rights to satisfy control conditions (iii) or (iv). Control condition (v) is not relevant as no trust or firm is involved.

Individuals and indirect control

An individual can meet any of the Conditions (i) to (iii) directly or indirectly. An individual who meets a control condition directly should always appear on the PSC register. A control condition is met indirectly where an individual holds their rights via another legal entity which itself meets one of the five control conditions. In that instance the individual must hold a “majority stake” in the intervening legal entity (ie holds or controls a majority of the voting rights, has the right to appoint or remove a majority of the board or exercises dominant influence or control over that entity). Indirect control may of course be via a chain of legal entities in which case the entity immediately above the company must be the one to meet one of the control conditions and each entity above it must hold a majority stake in relation to the entity below it in order for the chain of ownership not to be broken.

An individual who holds rights indirectly will not necessarily be entered on the company’s PSC register if the intervening entity is a registrable “relevant legal entity” (RLE). This is the exception to the general rule that all individuals who are PSCs should appear in the company’s PSC register. See section below “Companies and other bodies corporate as PSCs” below for further explanation.

Individuals and conditions (iv) and (v)

A company is only required to consider whether an individual meets control condition (iv) if he/she does not exercise control through one of conditions (i) to (iii). In those circumstances an individual may still have “significant influence or control” (SIOC) over the company and hence fall within condition (iv). Draft statutory guidance as to the meaning of SIOC can be found here and some explanatory notes are included in this briefing note (see “What is meant by significant influence or control?”).

Control condition (v) will only apply in limited circumstances. A company should consider if anyone who meets control conditions (i) to (iv) is a trust or firm (without legal personality4). If they are then a company must consider if any individual (other than the trustees or members of the firm) controls the trust or firm by virtue of SIOC and should therefore be included on the PSC register.

By way of clarification, where the assets of the trust or firm include ownership or control of the company meeting any of conditions (i) to (iv) then those trustees or partners should be included in the PSC register if they are individuals.

Companies and other bodies corporate – definition of RLEs

In many circumstances a company may not have any individuals who are PSCs as its shares are held by one or more legal entities (for example a subsidiary company in a company group structure). In that case it will be the legal entity itself that should be included in the PSC register if it is a “relevant legal entity” (RLE) and it is registrable. A company must therefore identify both its PSCs and its registrable RLEs on its PSC register.

An RLE is one which:

(a) would have been a PSC if it had been an individual (i.e. it meets one of the control conditions (i) to (v)); and

(b) it holds its own PSC register or it meets other deemed equivalent disclosure requirements (a company listed on the main market of the London Stock Exchange or whose shares are traded on a regulated market in the another EEA state or other specified markets5).

An RLE will be registrable in relation to the company if it is the first RLE in the company’s ownership chain. The purpose of this is to avoid multiple disclosure in a company’s PSC register of all RLEs in its ownership chain.

Comments above on the interpretation of control conditions (iv) and (v) in relation to individuals apply equally to RLEs.

Set out below are some illustrative examples which demonstrate the complexities in relation to PSCs and RLEs.

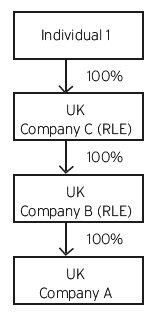

Example 2 – registrable RLEs

Individual 1 owns 100% of the shares of Company C. Company C is a UK company which must maintain its own PSC register. Individual 1 is therefore registrable as a PSC for Company C. Individual 1 is also a PSC for Company B (indirect control). He is not however registrable as a PSC for Company B as the intervening entity (Company C) is an RLE. Company C will therefore appear on the register of Company B. Likewise Individual 1 and Company C’s indirect control of Company A does not require them to appear on the register of Company A. Company B, an RLE, will appear on the register of Company A.

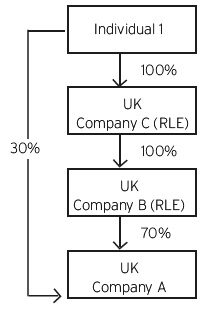

Example 3 – registrable RLE and PSC of a company

In this example Individual 1 holds a direct interest in Company A as well as an indirect interest by virtue of the ownership chain via Companies B and C. In this case the direct interest would be registrable in Company A’s PSC register. Company A must also include Company B on its register as its RLE. Company A it does not need to include Company C in its PSC register as Company C is not the first RLE in its ownership chain.

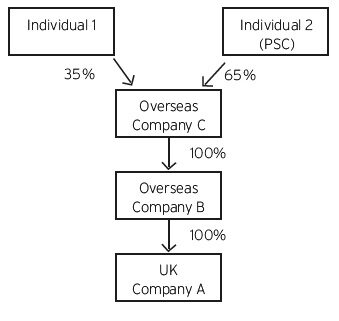

Example 4 – indirect ownership of individual is registrable, intervening legal entities are not RLEs

In this example Company A will not put Company B on its register as it is an overseas company and does not meet the definition of an RLE. The only exception to this would be an overseas company who meets the relevant disclosure standards i.e. its shares are listed on one of the markets specified by the legislation. Company A must therefore look further up its ownership chain. Company C is also not an RLE for the same reasons as Company B. Individual 2 is registrable as a PSC of Company A as it has indirect control. Individual 1 is not registrable as a PSC of Company A as it does not does not meet the definition of indirect control (it does not have a majority stake of Company C).

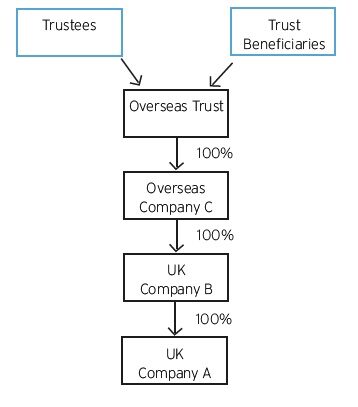

Example 5 – corporate structure including a trust

In this example Company A’s PSC register should identify Company B as its RLE; it does not need to look further up the ownership chain.

Company B cannot put Company C on its register as it is not an RLE (unless the overseas company has shares listed on a relevant market) and therefore Company B must look further up the ownership chain. As all shares of Company C are held pursuant to the Trust the trustees should appear on Company B’s PSC register (provided the trustees are registrable as either an individual or RLE). If any person has the right to exercise significant influence or control over the Trust (control condition (v)) they would also need to be identified in the PSC register. Trust beneficiaries who hold economic interests but do not have significant influence or control over the Trust generally do not need to be identified.

Additional considerations when identifying PSCs

There are some additional considerations that the more complex company structures will need to take into account:

Nominees

Where shares or rights are held by nominees then a company should treat them as if they were held by the person for whom the nominee is acting. The company must therefore consider if this person is a PSC or a registrable RLE.

Joint interests

Where two or more persons hold shares or rights in a company they should be treated as if each of them hold the total number of shares or rights held by all of them and be separately entered on the PSC register if one of the control conditions is met.

Joint arrangements

This is where two or more persons arrange to exercise their share rights in a pre-determined way. For the purposes of the PSC register they shall be treated in the same way as per joint interests.

Shares held by way of security

Generally speaking shares held by way of security for normal commercial borrowing purposes will be deemed held by the borrower provided those rights, save for the enforcement of security, can only be exercised in accordance with the borrowers instructions.

Interests held through a limited partnership without separate legal personality

This would include, for example, an English limited partnership. In those circumstances it is the general partner(s) who should be entered onto the PSC register if they are individuals or RLEs.

Rights only exercisable in certain circumstances

Rights which only become exercisable in certain circumstances will be taken into account when those circumstances have arisen and for as long as they subsist. If the circumstances under which they arise are within the control of the person entitled to exercise those rights they should be taken into account from the outset.

What is meant by “significant influence or control” – control conditions (iv) and (v)

Draft statutory guidance has been published on what is meant by a person having the right to exercise or actually exercising significant control or influence (SIOC guidance) in relation to companies here.

The SIOC guidance gives a non-exhaustive list of examples of what may constitute SIOC. This includes where a person has absolute decision rights (or in some cases veto rights) over decisions relating to the running of the business (e.g. adopting or amending the company’s business plan, changing the nature of the company’s business, appointment or removal of the CEO, establishing or amending profit share, share option or similar plans for directors or employees). Where a person is not a member of the board of directors but regularly directs or influences a significant section of the board or whose views influence decisions of the board then this may also constitute SIOC. This would include shadow directors.

A special exception is made in respect of minority interests. If a person holds absolute veto rights in order to protect certain minority interests (e.g. to protect against amendments to the company’s articles of association, dilution of their shares etc.) then this on its own is unlikely to constitute SIOC.

The SIOC guidance sets out examples which would not on their own result in a person being considered to exercise SIOC. This includes those working in a professional capacity, a managing director or a director with a casting vote, a person dealing with the company under a third party commercial or financial agreement.

The SIOC guidance also gives examples of the rights of a person to exercise SIOC over a trust or firm for the purposes of control condition (v).

What should companies do next to identify its PSCs and RLEs?

In some cases it may be relatively easy for a company to identify its PSCs and RLEs; for more complex ownership structures this may be more difficult and more time and care needs to be taken to identify the relevant persons. In general terms the government guidance suggests companies should:

- consider all documents/information available to identify any PSCs/RLEs;

- consider interests in the company held by individuals, legal entities, trusts and firms (partnerships without legal personality); and

- consider any joint arrangements or rights held through a variety of means which might ultimately be controlled by the same person.

Set out at Appendix 1 is a modified version of the government guidance giving further information as to sources to consider when assessing whether anyone satisfies any of the PSC Conditions.

Need further help / information?

You may find the following links helpful:

Birketts’ overview note on the PSC regime;

Birketts’ note identifying PSCs for simple corporate structures;

Government detailed guidance (non-statutory) on the PSC regime;

Draft statutory guidance explaining the meaning of “significant control or influence” for companies.

For further enquiries please contact a member of our Corporate Team.

1 This includes dormant and subsidiary companies, companies limited by guarantee (including CICs) and UK Societas Europaea (SEs).

2 The PSC regime does not apply to (i) UK listed companies with shares traded on the main market of the London Stock Exchange; (ii) UK companies with shares admitted to trading on a regulated market on another EEA state or on specified markets in Switzerland, USA, Japan or Israel. Note that the UK subsidiaries of such exempt companies are subject to the PSC regime and must maintain a PSC Register. Since 26 June 2017, the exemption has not applied to companies quoted on AIM and such companies have been required to keep a PSC register from 24 July 2017.

3 The definition of control in respect of an LLP is a modified version of conditions (i) to (v) which is set out in the Limited Liability Partnership (Register of People with Significant Control) Regulations 2016.

4 English limited partnerships are “firms” for this purpose. LLPs, Scottish partnerships and Scottish limited partnerships have legal personality and therefore are not firms for this purpose.

5 These are specified markets in Switzerland, USA, Japan or Israel as set out in Schedule 1 to the Register or People with Significant Control Regulations 2016.

Appendix 1

Practical steps a company can take to identify its PSCs and RLEs

This is a modified version of a table appearing in the Government Guidance.

| Condition | How to identify |

|---|---|

| Condition (i) Directly or indirectly owning more than 25% by nominal value of the shares. | Review the register of members, articles of association and statement of capital to identify blocks of shareholding over 25%. Consider carefully where any shares are held by nominees, where there are joint arrangements, interests held via limited partnerships etc. See “Additional considerations where identifying PSCs” of this note. Also consider indirect ownership arrangements. |

| Condition (ii) Directly or indirectly holding more than 25% of the voting rights. | Review the register of members, articles of association and any shareholder agreements to identify whether anyone holds more than 25% of the voting rights. Check for different voting classes of shares with different voting rights, any weighted voting rights, voting rights only exercisable in certain circumstances. More detail on this is set out in the government guidance. Consider whether voting patterns suggest that some shareholders are acting together (e.g. groups of investors). |

| Condition (iii) Directly or indirectly holding the right to appoint or remove a majority of the directors. | Review any provisions in the articles of association or any other agreement (e.g. a shareholders agreement) which concern the appointment or removal of directors holding the majority of votes at board level. If different directors have different voting rights at board meetings consider whether anyone has the right to appoint or remove directors who could carry a majority in board votes on all or substantially all matters. |

| Condition (iv) Having the right to exercise, or actually exercising, significant influence or control | Consider whether there is anyone else who does not meet any of the first three conditions above but does exercise influence or control over the company. Statutory guidance sets out what is meant by significant influence or control here but also see further notes within this guidance note. |

| Condition (v) Holding the right to exercise, or actually exercising, significant influence or control over a trust or firm which is not a legal entity but satisfies one of the above conditions | Consider whether anyone who meets the first four conditions is a trust or firm. If so, consider the individuals or legal entities who control the activities of the trust/firm and review the factors to be considered to determine whether they exercise SIOC over that trust/firm. If an individual exercises SIOC over that trust/firm that individual should appear in the company’s PSC register. If a registrable RLE exercises SIOC over that trust/firm the RLE should appear in the company’s PSC register. If the legal entity is not an RLE then the company will need to look further up the chain of ownership. |

The content of this article is for general information only. It is not, and should not be taken as, legal advice. If you require any further information in relation to this article please contact the author in the first instance. Law covered as at August 2017.